The energy dilemma

The pursuit of energy security is changing the investment landscape

There is a push to transition to cleaner energy, but governments appear to be falling back to fossil fuels amid Russia's threats to turn off the gas tap.

Is nuclear energy poised for a comeback? How has our understanding of energy security changed, and what impact if any will government legislation or lack thereof have on the transition to green energy?

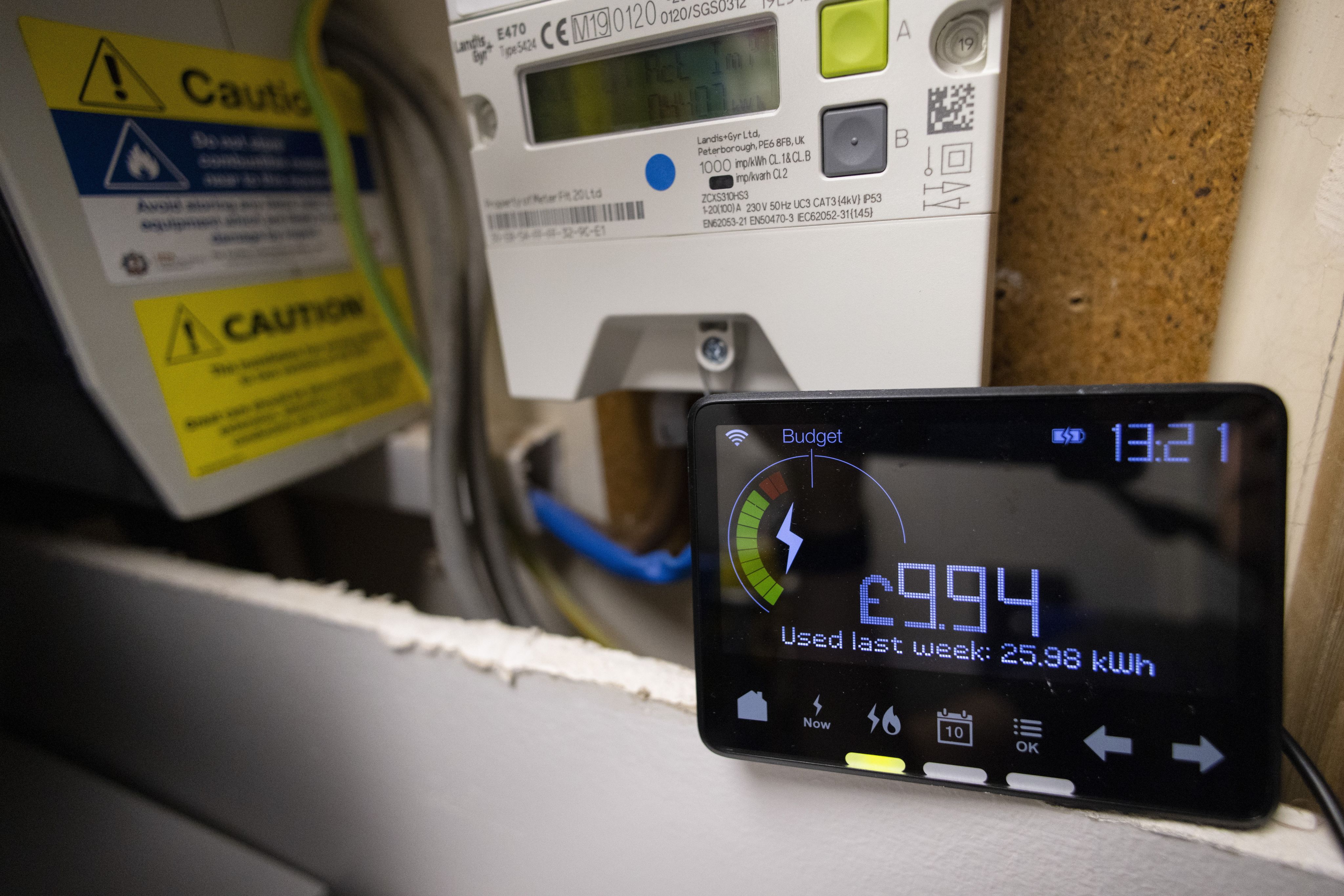

Rising energy prices are drawing investors to renewables

High energy costs are causing more investors to express a strong interest in renewable energy, according to the latest FTAdviser poll.

The poll, which asked advisers: how much more interested are your clients in investing in renewables since the cost of energy started rising, found that more than half (56 per cent) said very interested.

About a third said they were quite interested, leaving about 12 per cent who said their clients were not interested.

Nigel Green, the chief executive of de Vere, says as rising energy costs, which are fuelling the cost of living crisis, intensify, impacting the budgets of households and businesses, minds have been focused on seeking alternatives.

"As such, interest in investment into renewables is becoming front and centre in clients’ minds," Green adds.

The global energy crisis is only set to deepen. It is not going away any time soon.

It was started by the world economy rebounding from the pandemic faster than was anticipated, bringing to the fore supply and infrastructure issues.

Commenting at the time of the former chancellor Kwasi Kwarteng's "mini" Budget, Alex O’Cinneide, chief executive of Gore Street Capital, investment manager of Gore Street Energy Storage Fund, said that with an energy mix comprising a more significant proportion of renewable energy, there was to be more consistent pricing and greater energy security.

He added: “Over the last year, we have seen energy prices soar. This has been caused by the rapid increase in energy demand as economies re-opened following Covid-19 lockdowns and exacerbated by the current geopolitical situation in Europe.

“The average price of renewable generation in the UK is now below that of a conventional generator and not subject in the same way to the volatile movements in price that we are seeing.

“However, the inherent intermittency of renewables requires additional flexibility, which until recently has been provided by conventional generation. Renewables cannot produce this flexibility independently, so energy storage systems, such as the utility-scale battery assets operated by our fund, are needed.”

The invasion of Ukraine by Russia has also been a factor in the transition to green energy.

A recent survey by HANetf, a white-label ETF and ETC platform, found that 92 per cent of European wealth managers expected to increase their exposure to clean energy over the next 12 months.

Given the ongoing war in Ukraine, and the subsequent need to reduce reliance on Russian fossil fuels, it seems investors are looking to invest in alternative sources of energy.

This is further supported by the fact that 88 per cent of the respondents said they had recently invested in nuclear energy or uranium-focused funds.

While nuclear energy is not renewable, it is increasingly viewed as clean, given its relatively low carbon emissions.

More generally, 80 per cent of the wealth managers said they planned to increase their exposure to thematic funds over the next 12 months, with 74 per cent reporting increased interest in thematic investing from their clients.

But Green argues there are other causes of the current energy crisis. Demand is also surging due to a 1 per cent rise a year in global population growth, plus the increase in wealth and consumption of the growing global middle class.

Green adds: "The energy crisis, which is driving up prices, should serve as a catalyst for the energy transition.

"Clients, keen to get ahead of the curve as well as receive decent returns, are increasingly seeking out the opportunities.

" They’re now moving at pace to have an early advantage, foreseeing the undeniable value, necessity and rewards of investing in greener energy."

How renewables have become critical to energy security

The term ‘energy transition’, denoting the desired shift away from fossil fuels and towards renewable sources, is likely to be familiar to investors; particularly those who have at least considered incorporating environmental principles into their investment approach.

Another term attracting awareness is ‘energy security’, defined by the International Energy Agency as the uninterrupted availability of energy sources at an affordable price.

“Without a doubt, energy security has joined the energy transition as a top global priority,” says Mark Florian, global head of diversified infrastructure at BlackRock Alternatives.

“We are already seeing countries promoting investment in renewables as an important component of energy security, presenting opportunities for infrastructure investors.

"Higher energy prices also reduce the green premium for clean technologies such as renewables, potentially increasing their economic competitiveness.”

Nuclear energy back in the spotlight

Investors too are considering energy security, which has also highlighted the role of nuclear power as a source of low-carbon electricity.

In April, for example, the UK government published its energy security strategy targeting a “significant acceleration” of nuclear power.

“Energy security is arguably the greatest focus for investors outside of gilt stress and the hostility of central banks,” says Sam Peters, portfolio manager at Clearbridge Investments.

He adds that nuclear energy must play a role, citing a recent investment in a nuclear energy provider in the US.

For both investors and governments, there’s a growing recognition that pragmatism, particularly regarding nuclear power… is critical.

“The increased focus on energy security has put the spotlight on existing and recently decommissioned reactors,” says John Ciampaglia, chief executive of Sprott Asset Management. “Immediate implications on fuel supply from potential Russian sanctions has led to several countries extending the planned life of existing nuclear reactors.

“As nuclear reactors are only refuelled once every 12 to 18 months, and can easily store a reload of fuel elements on-site, they can operate independently of any fuel supply chain interruptions for two to three years.

"This is dramatically different from natural gas and oil power plants that consume large quantities of fuel, and have very limited on-site storage capacity.”

For investors and governments, recognition is growing that pragmatism is critical, particularly regarding nuclear power or transition fuels, says William Lough, portfolio manager of the R&M Global Sustainable Opportunities Fund.

The longer-term solution, he says, requires expansion in renewables capacity.

Nuclear energy has been hyped again as a potential solution to the energy security conundrum, however it remains a poor option to us.

But Thiemo Lang, senior portfolio manager of the Polar Capital Smart Energy Fund, views nuclear energy as a “poor” solution to energy security.

He cites nuclear reactors in France being shut down for maintenance, and delays in the construction of power stations that have also exceeded their original budget.

Stephen Metcalf, head of sustainable investing at RBC Wealth Management, likewise says that while nuclear power can be a “useful tool in the future energy mix”, it is difficult to increase capacity quickly.

“It’s a 20-year investment project from scratch, in the UK at least; so while it makes sense to keep existing capacity online, without a huge leap forward in the technology, we don’t think it makes sense to invest as much in nuclear as it does renewables,” Metcalf adds.

A temporary solution?

So are domestic fossil fuels the answer? Perhaps - for now.

Besides a renewed interest in nuclear energy, in September the UK government lifted a fracking ban with the aim of boosting the country’s energy security - although the ban has been reintroduced under the new government - and confirmed its support for an upcoming oil and gas licensing round launched by the North Sea Transition Authority.

Greater exploitation of fossil fuels is not a long-term solution, it is purely a near-term response to the acute shortages we face.

But any increase in fossil fuel consumption should be seen as a temporary reaction to immediate geopolitical issues, says Stephen Metcalf.

Metcalf adds: “It won’t be the solution in 20 years. There are short-term tactical benefits to holding traditional energy exposures in your portfolio, but we do not expect this to last.

"We still see renewables and the broader energy transition as a key investment theme and big opportunity for investors.”

Gabriela Herculano, manager of the iClima Global Decarbonisation Enablers UCITS ETF, goes further by describing any fracking ban lift and support for the licensing round as a “completely futile effort that will not help the energy crisis for years to come”.

Herculano adds: “It takes a really long time to develop a new oil and gas field; and oil and gas companies do not underwrite investments based on spot prices for crude, but rather on long-term prices.

“There are many scenarios in that key markets… accelerate the energy transition very successfully; and with that electrify transportation and heat, and therefore reduce global demand for crude and gas.”

Instead, Herculano cites short-term solutions to the energy crisis being ‘behind the meter’, such as solar rooftops and energy efficiency.

Most of the public will be shocked to learn that we waste two-thirds of the world’s energy.

Jonathan Maxwell, chief executive of Sustainable Development Capital, the investment manager of Sustainable Energy Efficiency Income Trust, likewise describes energy efficiency as one of the “fastest, cheapest and most reliable” ways to improve energy security.

“Such measures quickly [pay] for themselves in terms of the cost savings they deliver, and then [go] on to produce further savings… Most of the public will be shocked to learn that we waste two-thirds of the world’s energy.

“Energy efficiency measures can be introduced rapidly to deliver immediate benefits. This is a real advantage now, and especially when renewable and nuclear energy sources can take years to develop.”

Higher energy prices are also reducing the payback time of most energy efficient solutions, says Lang at Polar Capital, and make green energy more cost competitive. “Electric heat pumps’ payback times, for example, have moved from five-to-six years, to two-to-three years.

Lang adds: “In addition to the reduced payback time, the cost stability and visibility of renewables is coming into the spotlight in an environment of volatile and elevated commodity prices. We expect this to drive increased interest from households but also from corporates desiring more visibility on their energy costs.”

Renewables impact on energy prices

Rising energy prices seem to be interpreted by certain actors as a call for further fossil fuel investments, says Jose Lazuen de Zuloaga, senior sustainability analyst at Lombard Odier Investment Managers. But he adds that the “economic reality” of fossil fuels has not changed.

Lazuen de Zuloaga adds: “Fossil fuel supplies are limited and therefore inflationary over the long-term. On the contrary, the availability of renewable energy is unlimited, despite seasonal moments of scarcity.”

Julien Girault, a sustainability analyst at Allianz Global Investors, says any upscaling of liquefied natural gas, recommissioning of coal-fired power stations and resumption of fossil fuel exploration and production will require an accelerated renewable path once we exit the energy crisis.

Most investors are looking at the long-term secular trends toward low carbon generating technologies.

Vimal Vallabh, partner and global head of energy at Morrison & Co, says he has seen a noticeable uptick over the past six to seven years in institutional investors seeking exposure to the renewables sector.

Vallabh says: “The current increase in energy prices hasn’t impacted that appetite at all. Most investors are looking at the long-term secular trends toward low carbon generating technologies and electrification of our transport, heating and industrial activities.”

Higher gas and electricity prices have also led to higher potential profitability for renewable energy generators, says James Smith, manager of the Premier Miton Global Renewables Trust, which he says should incentivise more renewable development.

Gas prices often determine the wholesale electricity price, despite cheaper electricity being produced by renewables.

Smith adds that governments are keen to limit what they view as excess profitability in the renewable sector, in order to help reduce energy prices: “However, a balance must be found between alleviating high prices and maintaining incentives to invest in new renewable energy.

“In terms of new electricity capacity, aside from nuclear, which takes many years to build, new renewable energy assets are the only realistic source of new large scale electricity capacity. It is imperative that governments strike the right balance between incentivising investment and keeping prices at an affordable level.”

Source: Ofgem

As gas prices often determine the wholesale electricity price, the UK government recently closed a consultation on electricity market reform, including changes to decouple global fossil fuel prices from electricity produced by cheaper renewables.

De Zuloaga at Lombard Odier adds that when ‘green’ technologies reach cost parity with their fossil fuel equivalents, demand growth is prone to escalate exponentially.

“But [this] requires regulators to address key bottlenecks, to allow these technologies to deploy their true cost-saving and environmental potential," De Zuloaga adds.

“For example… we are seeing how marginal pricing mechanisms in the electricity markets are pricing cheap renewable power at the same level as the most expensive generating (fossil) asset, creating a windfall for producers but a tense situation with regulators and consumers.”

With green energy already being cost competitive against traditional energy in most geographies, Lang at Polar Capital predicts the gap between the two will continue to increase.

“Renewables still see a high technological innovation and the larger manufactured volumes bring higher operational efficiencies, helping to make green energy more and more compelling.”

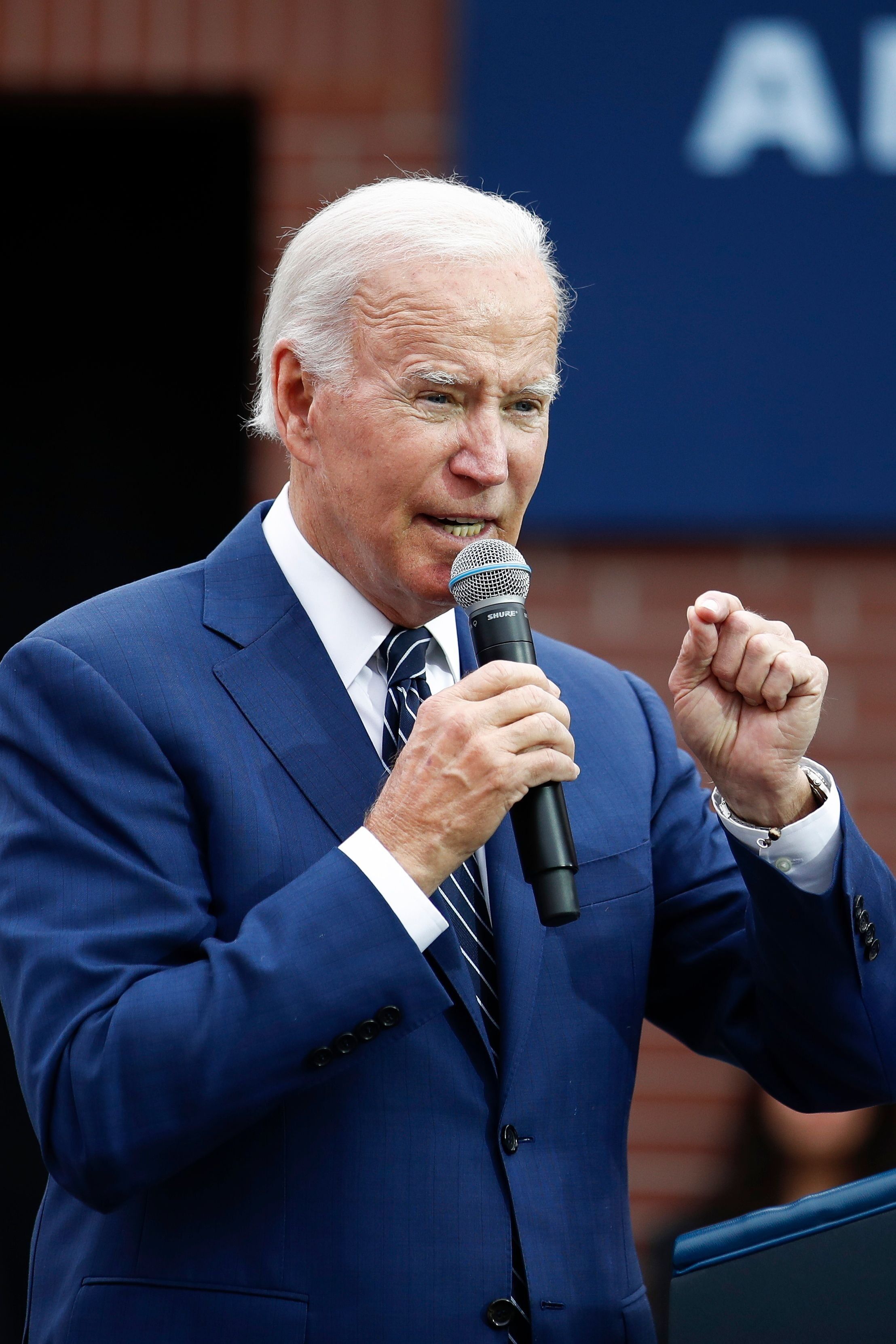

The role of governments in the energy transition

While investors and private sectors can play an important role in supporting the energy transition, Florian at BlackRock says the world will not achieve an “orderly, just” transition to net zero without sustained and consistent government policy.

Citing the US Inflation Reduction Act, Florian says: “By dedicating financing and incentives, [the Act] has the potential to accelerate the development of renewables…

“Not only can government policy play an important role in growing the adoption of green energy, clear and consistent policies also provide a stable regulatory landscape that is attractive for investors and other private sector players to deploy capital into.”

Lough at River and Mercantile agrees that government incentives have a role in scaling up renewable energy: “At a recent renewable energy conference, I was struck by two things in particular. [One] was how consistent the refrain was that to make the many technological solutions that now exist in carbon capture, renewable energy, storage, etc cost-competitive, requires scale.

“Clearly, this is something of a self-reinforcing loop, and in order to ‘crank the handle’ to gain scale and set in motion positive feedback loops, government incentives will need to play a role.”

Indeed, Vallabh at Morrison & Co says the longer a government avoids playing a leading role, the more radical its intervention is likely to be needed later on.

Vallabh adds: “The sheer scale of capital needed to address the challenges posed by climate change and the cost of the transition means whatever policies governments decide to adopt, they need to be able to attract private capital into the sector, as government balance sheets alone just don’t have the capacity.

“We either pay for the transition now at a lower cost, gradually and over time to prevent a catastrophic outcome; or we pay significantly more later on and have to deal with the resultant social consequences.

“One thing that is certain, there is no avoiding it. Some governments have been proactive and encouraging of the transition, whether for security or climate reasons; others have lagged behind.”

(Credit: Armin Weigel/dpa via AP via Fotoware)

(Credit: Armin Weigel/dpa via AP via Fotoware)

(Credit: PA Wire/PA Images via Fotoware)

(Credit: PA Wire/PA Images via Fotoware)

(Credit: Chris Ratcliffe/Bloomberg via Fotoware)

(Credit: Chris Ratcliffe/Bloomberg via Fotoware)

(Credit: CAROLINE BREHMAN/EPA-EFE/Shutterstock via Fotoware)

(Credit: CAROLINE BREHMAN/EPA-EFE/Shutterstock via Fotoware)

(Credit: Photo by Alex Azabache via Pexels)

(Credit: Photo by Alex Azabache via Pexels)

(Credit: Angel Garcia/Bloomberg via Fotoware)

(Credit: Angel Garcia/Bloomberg via Fotoware)

(Credit: Photo by cottonbro via Pexels)

(Credit: Photo by cottonbro via Pexels)

(Credit: Photo by Guillaume Falco via Pexels)

(Credit: Photo by Guillaume Falco via Pexels)

How can investors in resources respond to climate warnings

This year has brought stark warnings over the devastating impacts climate change could have.

We look at what this means for investing in resources such as food, water and energy.

Pressure on the global food and water system is growing as a result of climate change, and time to address its potentially disastrous consequences is running out.

Fresh warnings on rising global temperature are emerging with increasing frequency.

For example, the World Meteorological Organization recently estimated that Earth has an almost 50 per cent likelihood of temporarily crossing the crucial 1.5C climate change threshold before 2026.

Meanwhile, the most recent report from the Intergovernmental Panel on Climate Change made it clear that we are already seeing irreversible impacts from climate change.

It also highlighted that without significant and immediate action, across all sectors and countries, the consequences are likely to be catastrophic.

The rapid phase-out of coal and methane emissions is needed, so too a massive ramp-up in capital investment in transitioning to a low-carbon world, and carbon sequestration and reforestation.

Without this action we will see rapidly rising sea levels, more extreme weather events, habitat loss, and worsening shocks to the world’s food supply.

More than 40 per cent of the world’s population is “highly vulnerable” to climate change, according to the IPCC.

The global population is expected to exceed 10bn by 2050, which will require producing 70 per cent more food and water compared with 2010 levels (Source: FAO, USDA, OECD, Our World in Data), and a similar ramp-up in energy consumption.

How we get there, and, specifically, the changes we make in the next decade, will shape the world profoundly.

Nature-based solutions and technology will play a crucial role

A key point from the IPCC report is that we need to stop thinking about climate change as an isolated problem that can be solved by just offsetting or lowering carbon emissions.

The global environment is inherently interlinked, and wider land usage is a key variable.

Climate modelling assumptions made by the IPCC, and similar organisations, factor in certain land usage, and natural carbon stabilisation from ecosystems like peatlands, forests and the oceans.

Natural environmental stabilisers are being destroyed at an alarming rate, and are approaching a tipping point where negative feedback loops will cause these essential natural resources to degrade irreparably.

Food production accounts for 25 per cent of greenhouse gas emissions, 65 per cent of freshwater usage, and 40 per cent of land usage, according to FAO, with food production often happening near to or even using key stabilising ecosystems, such as the ocean or rainforests.

The IPCC emphasises that we need company practices to not only minimise the environmental damage they inflict, but actually encourage the recovery of these natural assets.

If the food system adopted certain land use practices it would be hugely beneficial for climate change mitigation.

Such practices include intercropping (growing more than one crop in close proximity), using winter cover crops to encourage soils with greater organic content, and increasing organic inputs..

Forestry and biofuels are also increasingly being used to offset or replace carbon emissions from the energy and transport system.

Both of these will put further strain on land use and the natural stabilisers if not managed correctly.

This highlights the importance of nature-based solutions and technologies that can improve the yield and resource efficiency of how we produce essential things like food and energy.

What role do investors play?

Changes to the energy transition, food and water value chains are going to involve a huge reallocation of capital; upwards of $130tn (£112.3tn) over the next 30 years, based on BNEF, WRI and UN estimates.

Traditionally, this kind of capital shift has catalysed share price performance in companies successfully generating returns from higher capital expenditure.

We see multiple drivers and sources of this capital, and the IPCC report highlights that we need the solutions and drivers of change to be as wide-reaching as the problems we face.

But the solution for investors is not as simple as divestment from certain companies, or taking one or two token positions in 'ESG champions'.

This is a multi-decade trend that will be widespread and will require an investment perspective that manages the nuances within, and interconnections between, the most influential constituent subsectors of the changing systems.

As investors in both food, water and energy transition themes, we aim to follow a three-pillar approach to sustainability:

1) Create a universe of potential investee companies that covers the whole value chain in these thematic areas, while remaining focused on the problem these investments are trying to help solve;

2) Company-by-company ESG and sustainability analysis, to ensure that we differentiate companies on how they operate as well as their business purpose;

3) Engagement, with both the incumbent companies and those offering the products and services we need.

Another core message of the IPCC report is that we must avoid “maladaptation” that has negative unintended consequences.

Instead, the report advocates policy, and investment, that encourages companies to manage the whole range of stakeholder needs and outcomes, including social justice.

The United Nations’ Sustainable Development Goals offer a tangible way of assessing which companies are balancing wider environmental objectives with important social objectives.

The IPCC report offers a timely warning to the perils of inactivity, and makes it clear that we have only seen the very beginning of the change that is required across systems like energy, food, and water.

Overall, investment in agriculture and land sectors are going to have to increase by three to six times versus current levels in order for climate change to be effectively mitigated.

Investors, companies, governments and organisations like the IPCC need to ensure that data, capital and regulation are aligned to efficiently drive the changes we need before they become even more burdensome and difficult to make.

Felix Odey is portfolio manager of global resource equities at Schroders